Case Studies

Our mission is to provide medical practices relief from bad debt and aging receivables. We help you grow your practice by getting more of your receivables into your bank account, where you can use them

METHODOLOGY

Capital Services process is simple by design, matured > 50+ years and successful, as evidenced by our Medical clients’ satisfactory results.

A SUCCESSFUL VENTURE FOR IHN

A 753 Bed South New Jersey Hospital System with Revenue an Excess of $1.1 Billion and Over 100 Locations.

IHN is a non-profit hospital system providing care to south west New Jersey comprised of three main hospitals, a comprehensive cancer center, several multiple-specialty health centers with a total of more than 100 locations. These include urgent care; outpatient imaging and rehabilitation; numerous specialty centers, including sleep medicine, cardiac testing, digestive health and wound care; hospice and home care; and more than 30 primary and specialty physician practices in Gloucester, Cumberland, Salem and Camden counties. They have been aggressively expanding their footprint in southern New Jersey, Burlington County, with specialty and urgent care facilities and are in process of building a new 350,000 sq/ft facility with an additional bed count of 200.

IHN began working with Capital Services in 2013. They had just merged with multiple hospitals to create a larger healthcare system. It resulted in expanding clinical services and diminishing back-end staff. Having multiple vendors working the AR cycle simultaneously was challenging. In addition the ever moving target of compliance, expansion of Medicaid and Charity Care was reducing hospital revenues. They needed to shorten the AR billing cycle with little to no interaction on their part. They requested no patient complaints on services and total autonomy over account handling and ownership. We become a friendly and knowledgeable staff that was an extension of the billing office. We made decisions in the best interest of the client and patient to maximize revenue from for a minimal fee. This dedication resulted in more than a 110% improvement of Revenue Cycle Recoveries.

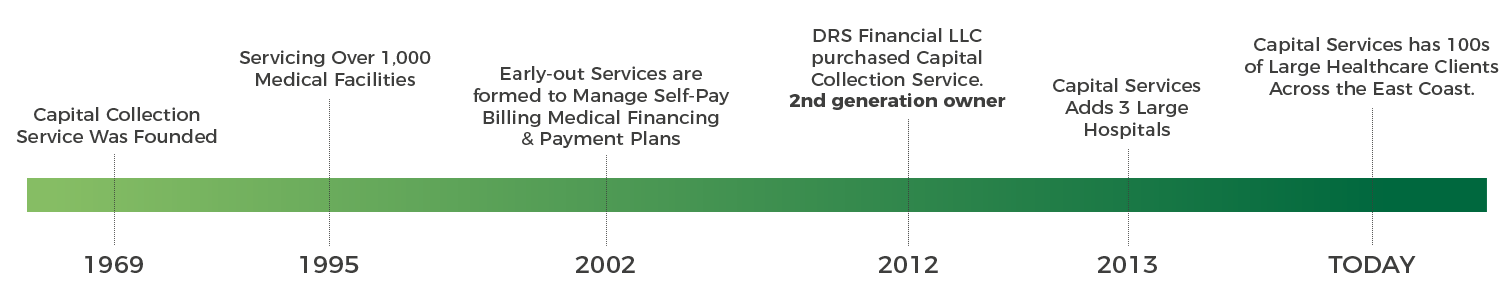

We’ve Done This for Years.

Capital Services is no stranger to working with complex hospital systems, programs, and services.

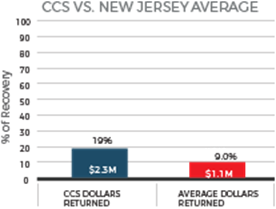

HISTORICAL REVENUE

- Patient pay collection

- Duration: 2015

- Placement Volumn: $12,337,427

- Revenue collected: $2,344,300

- Cumulative revenue recovery: 19%

- Continency fee: 13.5%

- Costto hospital: $316,480.50

- Accounts placed: 25,946

- Accounts returned: $501.00

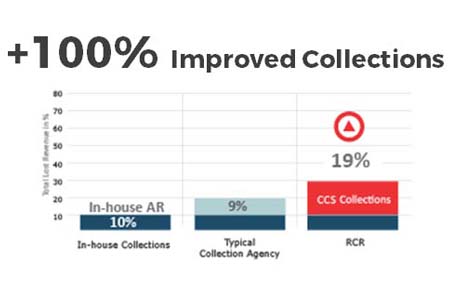

More Net-back

Capital Services more than doubles the recovery of the average recovery rate for other New Jersey based collection agencies.

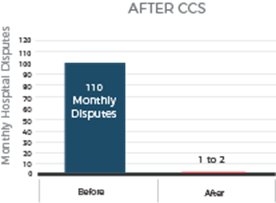

99.9% Reduction in Hospital Patient Disputes

- Satisfaction survey

- Duration: 2015

- Accounts: 25,946

- Accounts returned: 19,611

No Patient Disputes

Patient satisfaction is Capital Services primary goal. Our HFMA Patient Friendly Billing practices & Dispute resolution protocol virtually eliminates hospital complaints.

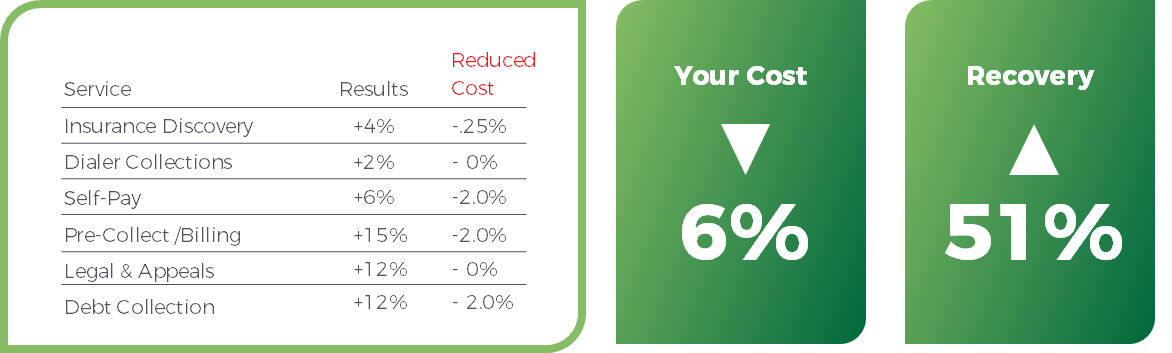

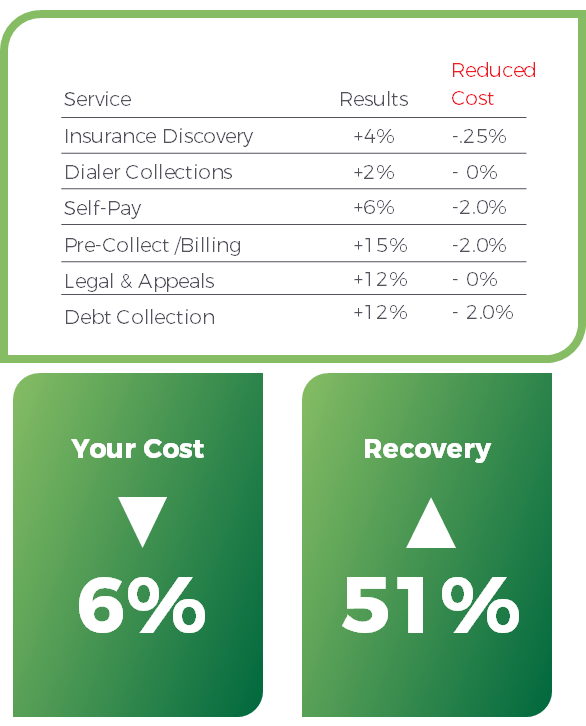

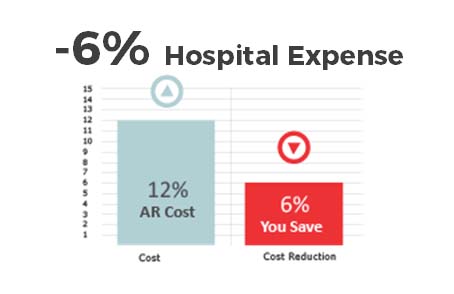

COST VS. BENEFIT STUDY

Reduce Cost by Half

Capital Services plans to reduce your back-office costs by half in the first 12 months working with us.

Increased Collections Over 110%

Capital Services Partners see an average of 19% in hospital bad debt colltection working with us in the first 12 months.